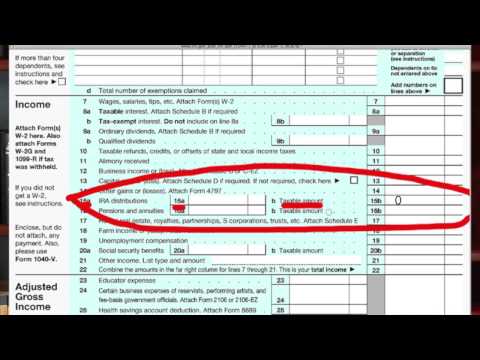

Okay, it's tax time and you open up the envelope from your old IRA custodian. Instead of a 1099 R form, they issued you something called a 1099 are, which you know is non-taxable because you moved it over into your self-directed 401k plan. However, you're not sure how the federal government, specifically the IRS, will know that you don't owe taxes on that amount. Well, here's a little secret: on your 1040 form, you will find a line 15a that asks for the amount of any distributions from your IRA. You can simply put down the dollar amount mentioned on the 1099 are on line 15a of your tax return. Now, moving on to line 15 B, which is not really a line but another section on the same line. It asks for the taxable amount. As long as you roll all the money into your brand-new 401k plan within 60 days of receiving it, you can put down the taxable amount as zero. In case you did a direct transfer, wherein the money went directly from your IRA to the custodian, or a direct rollover, regardless of the various names they may have, you still report the taxable amount as zero. After completing these steps, make a quick note on your tax return stating: "Reference line 15a: I transferred my money from my IRA over into a qualified self-directed 401k plan. Thank you very much." This simple note ensures that the IRS does not question the whereabouts of the 1099 are and the transfer of funds to another IRA. This is all you need to do to resolve any reporting issues with the IRS. If you have any further questions, please feel free to contact us by phone or email. Thank you very much.

Award-winning PDF software

5500 ez 2025 Form: What You Should Know

It also is used by certain foreign plans (as defined under) and certain non-U.S. plans. The filing date for the 2025 Form 5500-EZ will be April 20, 2019. Filing may be made through the IRS's Online Filing Service or by paper filing via paper filing instructions. 2018 Filing and Payment Options The 2025 Form 5500-EZ and 2025 Form 5500-EZ both have the same 2025 filing and payment options. Pay by Check: For tax return filers, the filing date is April 20, 2018. You can mail the check for the 2025 Form 5500-EZ to the IRS address in the 2025 Form 5500-EZ notice. For tax return filers, the filing date is April 20, 2018. You can mail the check for the 2025 Form 8379 Form 941 (or Form 944, if filing the same return) to the IRS address in the 2025 Form 8379 notice. However, this option is only available for the 2025 Form 709, 8379 Form 941, etc. Notice of Refund, if applicable. This option allows you to file an amended return at any time before the form is mailed back to you. This allows for an amended Form 5500-EZ to be filed when necessary. If filed online, the amended return will be mailed to the mailing address on file with the IRS within 10 days (excluding statutory holidays). Payment by Credit Card Payment by check payment will be received after the Form 5500-EZ is filed with the IRS. Payment by credit card will be received after the Form 5500-EZ is received by the IRS and is verified by IRS. Filing by check or with credit card will be accepted in any branch office of the Internal Revenue Service. Payment by credit card will only be accepted in the following instances: if a check is mailed or delivered to an IRS office, or to an IRS field office for processing in that office; or to a branch office of the IRS that serves a particular address outside the United States (for example, in the Caribbean). Filing by check or with credit card must be made payable to the Internal Revenue Service and must clearly indicate that an electronic filing is to be made using payment methods listed above. Failure to file will result in the return being considered invalid and a failure fee being assessed for the failure.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 5500-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 5500-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 5500-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 5500-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5500 ez 2025